How to apply for a Rakuten credit card

by Chloé

A step-by-step guide to applying for a Rakuten Credit Card in English, from picking the right card to how to link your bank account and everything in between.

Japan is known for being a cash society. It is less common here to pay by credit card, and people often carry a lot of cash with them. That’s fine in daily life, but you sometimes need a card when it comes to online shopping or booking a trip.

However, as a foreigner, it can be tricky to get a credit card in Japan. Using your credit card from your home country might lead to expensive fees, and it is of no use in case you get paid on a Japanese bank account.

For many Japanese banks, a working visa is not enough to prove your creditworthiness. Many foreigners have applied to get credit cards from their banks but were rejected, without real explanations.

READ ON Credit Cards options in Japan

Today, I will tell you all about a solution frequently chosen by expats in Japan – the Rakuten card – and walk you through the application form. Feel free to just scroll through to see what you will need or check out our tips for a smooth application.

コンテンツ

1. Benefits of having Rakuten card

It is often considered the easiest card you can hope to get as a foreigner. It is also quite convenient, as you do not need to go to an actual bank, with impossible opening hours. All you need to do is apply on the internet and it will be delivered to you.

That also means you don’t need to have a はんこ(personal seal, used instead of your signature) to apply, often required in regular banks. However, you still need to have a job, as they will call your workplace for an identity check.

2. Types of cards

Rakuten offers several types of cards (including cash card, business card, etc.). Below, you can find the three main credit cards.

楽天カード – Basic card

The default option, free of charge. You can choose between MasterCard, JCB, or Visa. However, special designs (think adorable pandas) are not available in the Visa version. It also allows you to collect Rakuten points while shopping (1 point per 100yen).

楽天ピンクカード – Pink card

Same as the basic card, plus special advantages for women (special discounts with selected services, this kind of things). And it’s pink, so what else.

楽天ゴールドカード・プレミアムカード – Gold/Premium card

This card comes with a yearly fee of respectively 2.160 and 10.800yen. You get advantages like free lounge at the airport, and higher credit limit.

Below I will explain the application process for the basic Rakuten card. Rather than explaining what’s written on the screen I go over what is necessary, what’s not and some background info. So when you apply you know what you need to prepare and don’t sign up for a service you don’t need. Once you applied it will take 1-2 weeks until you receive your card by mail.

3. Application form

Step 1

Access Rakuten card website

Go to the Rakuten website and click on the red カンタン申し込み (easy application) button. (If you don’t have a Rakuten account, you’ll be able to create one during the credit card application. If you’d rather have an English form, you can also create an account here.)

Step 2

Fill in the basic information

1. Card type and design

Select the card category from JCB, MasterCard and Visa. You can then choose the design (choices are more limited for Visa).

2. Your name

You will need to fill in your name three times, once in katakana (instead of kanji), once in hiragana, and finally using the Latin alphabet (they will automatically guess the spelling based on the hiragana you put in, but it will most likely be wrong).

※If your name is too long to fill in, contact Rakuten directly. They will send you a document you can send in to submit your name. Believe me, you don’t want to have the “wrong” name (for example, a name that’s cut off halfway through) on your credit card – it can lead to issues down the line.

3. Gender and Birthday

Select your gender: 男 (おとこ) male, 女(おんな)female. You have to choose one of these two – there is no “other” option (old-fashioned, I know).

You need to be 18 or older to apply.

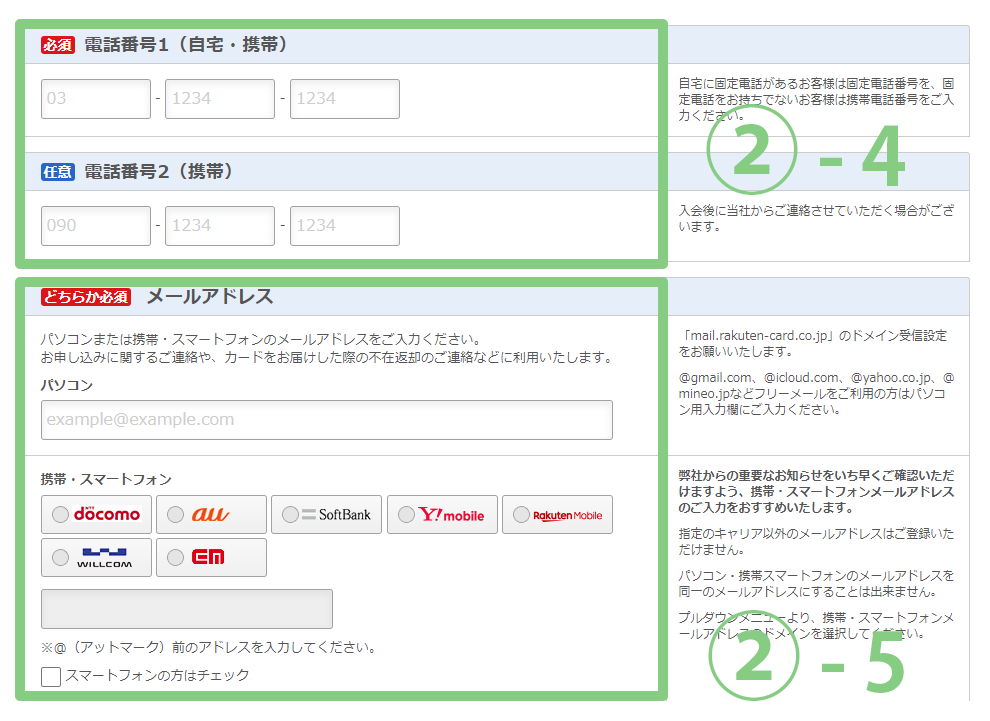

4. Phone number

There are two fields here – you only need to fill in the first one.

5. E-mail address

Fill in your e-mail address. The first option is for regular e-mail addresses like Gmail, Hotmail and other providers. The second option is for addresses provided by Japanese phone carriers. You only need to fill in one of the two.

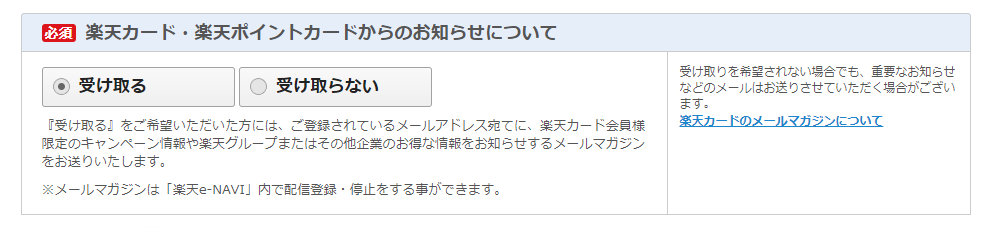

6. Rakuten newsletter (optional)

Choose whether you’d like to receive the Rakuten newsletter. The default option is “yes” (left), so make sure to not skip over this if you don’t want any updates and info on campaigns etc.

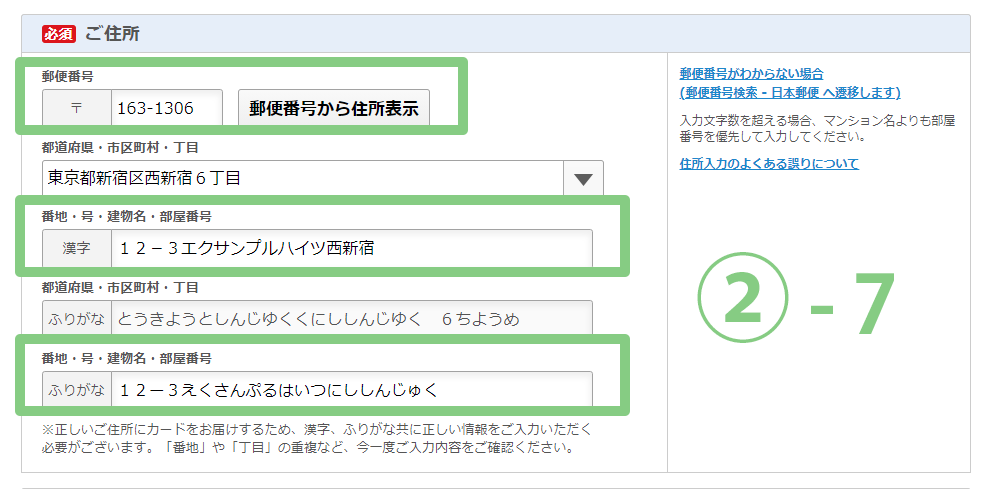

7. Address

Your card will arrive as registered mail, so you will have to receive it in person.

Start with entering your postal code in the first field, then click the button next to it. A pop-up will suggest the rest of the address. Choose the right one. A hiragana (furigana) version will be automatically generated in the 4th field. Then, manually fill in the rest of your address (the remaining two numbers, the name of your building, and your room number). Add furigana for this part of the address in the fifth field.

※You can only apply with a Japanese address.

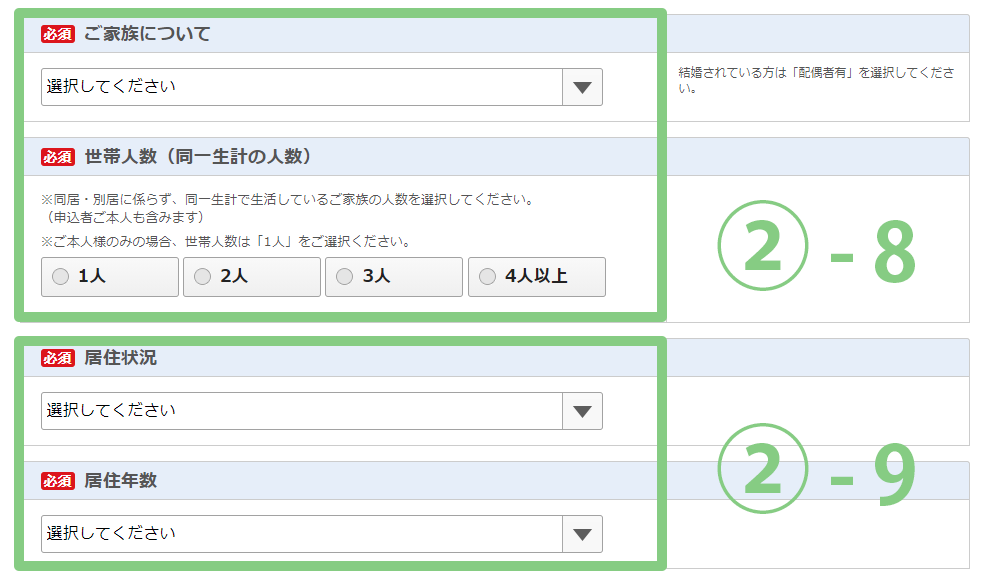

8. Family situation

In the first field, choose between: Spouse + kids / spouse + no kids / no spouse + kids / single (living alone) / single (living with parents)

In the second field, indicate the number of people in your current household. When indicating the number of people living together, include yourself in the count.

9. Housing

This section is about the type of housing you are living in. Options are quite detailed, even asking for the owner in case of individual houses (I assume for financial reasons).

Once done, add how long you have been living there from the second drop-down menu.

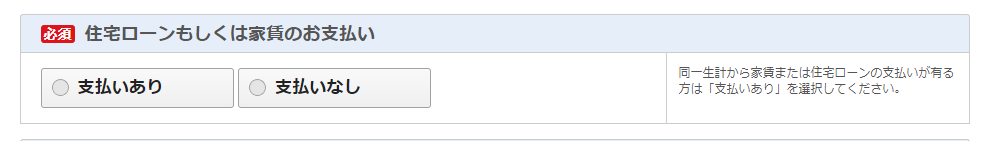

10. Loans

Check left if you are paying off a loan, right if you do not.

※You also need to check yes if you’re living together with someone who is.

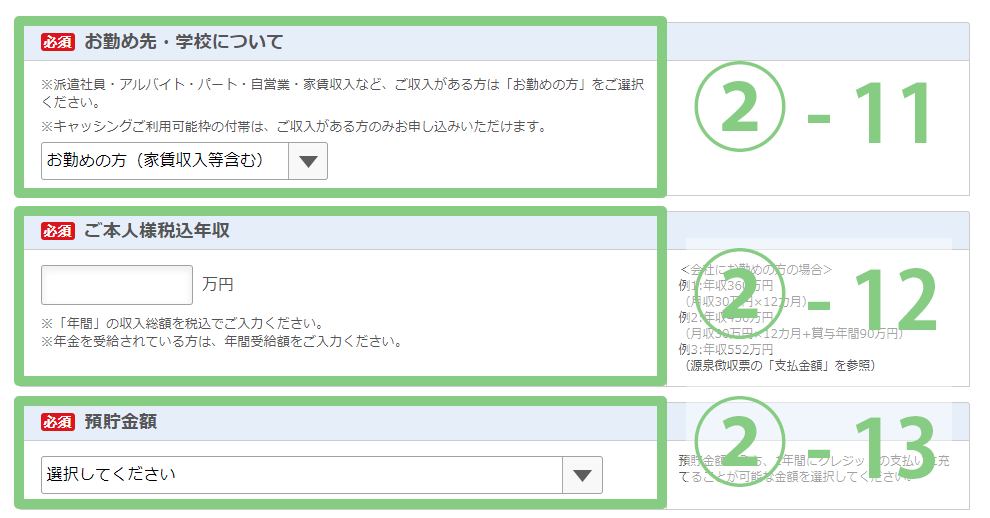

11. Employment

Choose your working situation. The choices are simple: employed / student / retired / unemployed

12. Annual income

If you indicated you are employed or retired, you will then be asked about your annual household income. Fill it in 万円(まんえん, 10K¥). If you chose ‘student’, you will be asked whether you have any income. If you check yes, indicate the amount.

13. Savings

This field asks about your savings (in yen) – or rather, the amount of your savings you want to make available for payment with your credit card each year. You have the option to not declare how much you have in the bank.

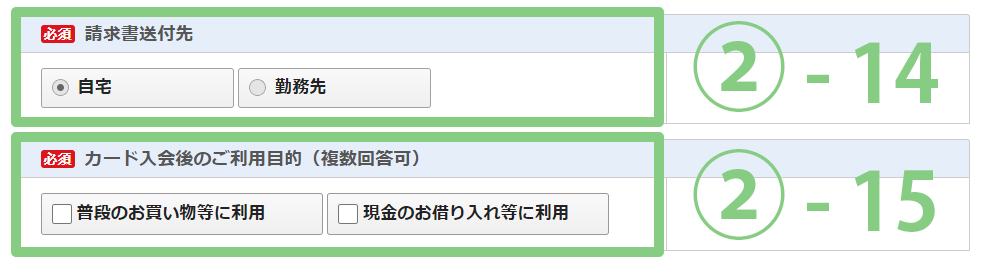

14. Invoice

You can receive the invoice at your house (left button) or at your workplace (right button).

15. Reason for application

Indicate the reason why you are applying for a Rakuten card: For shopping / to get a loan

(Better check shopping to increase your chances.)

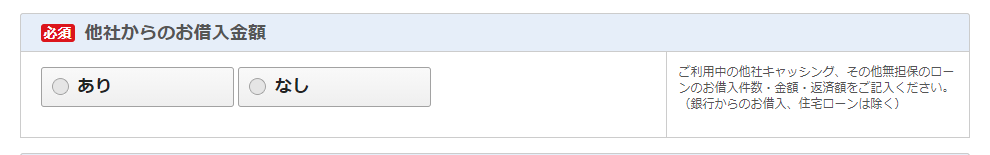

16. Loan, the Second

Indicate whether you got a loan from another company.

17. Edy function

Adding the Edy function is free and allows you to pay at selected stores by placing your card onto a card reader. Essentially, it’s a prepaid card inside of your credit card. To use it, you first need to charge it up.

18. Edy, automatic charge settings

By choosing this (free) option, your Edy card will be automatically charged when the amount of money you have left on it falls beneath a certain amount.

First pulldown: your card is automatically charged when you reach this amount

Second: amount charged

Third: daily limit

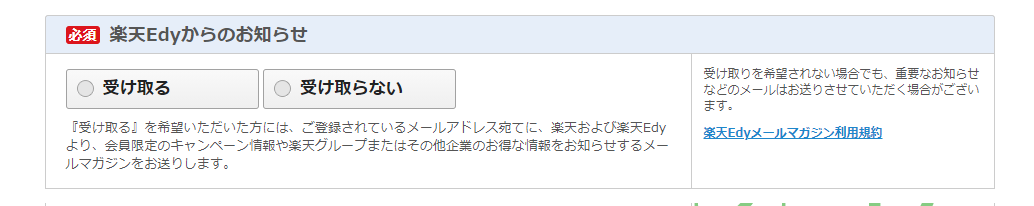

19. Edy newsletter

Choose whether you want to receive the Edy newsletter or not. Left for yes and right for no.

20. Bank account

Select the bank of the account you wish to link your Rakuten card to. You can either select your bank and fill in your account details directly (in a later step of the credit card application) or have Rakuten send you the paperwork to your home. To get receive the documents in paper form, choose the 郵便で口座設定手続き box at the bottom.

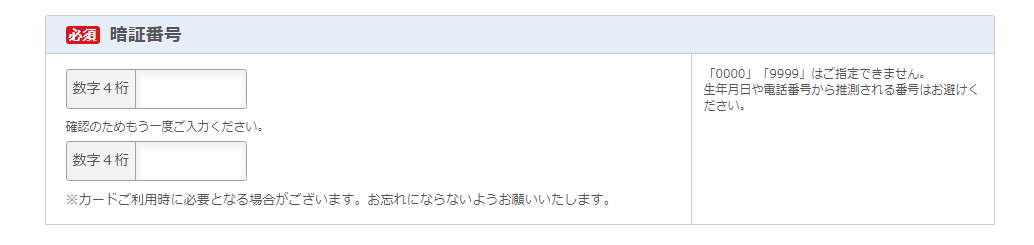

21. PIN code

Choose a pin number for your card (enter it twice). When you’re all set, click the yellow button to go to the next step.

※Remember your PIN! You won’t be able to inquire about or change it later on.

Step 3

Fill in information about your workplace

1. Company name

If you previously indicated that you are currently working, you then have to fill in your work information. First, choose your company type from the list, then fill in the company name in kanji and hiragana.

2. Prefecture (of your workplace)

Select the prefecture you are working in. Check Wikipedia if you need help with the Kanji.

3. Phone number at workplace

Fill in your workplace phone number (no mobile numbers allowed). They are very likely to call you at work to check your identity.

4. Time at company

Indicate how long you have been working at your current company.

※Selecting less than a year still makes you eligible for a credit card, so don’t worry about it.

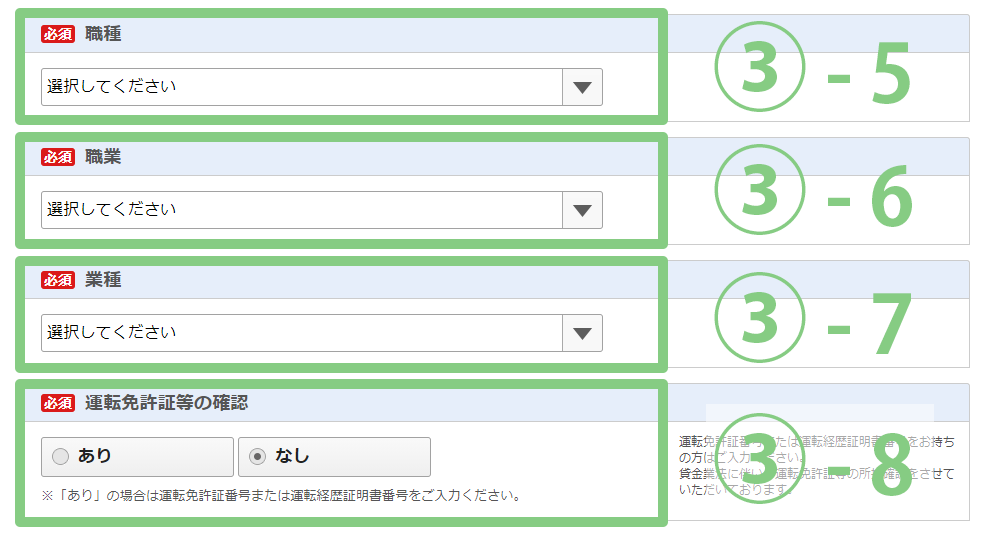

5. Job type

Choose your job category from the following list: Sales / service / office work / HR / education / sales representative / science / driver / other

6. Employment status

Choose your employment category among the following options: Employee / self-employed / civil servant / part-time / contract employee / board member / other

7. Industry

Choose your industry from the list: Manufacturing / service / wholesale or retail / education or healthcare / information and communication / public service or organization / construction / finance or insurance / freight / catering trade / real estate / publishing / electricity or gas / agriculture / other

8. Driver’s license

Indicate whether or not you own a Japanese driving license. If you say yes, a field will appear so you can fill in your license number. When you are all set, click the yellow button to go to the next step.

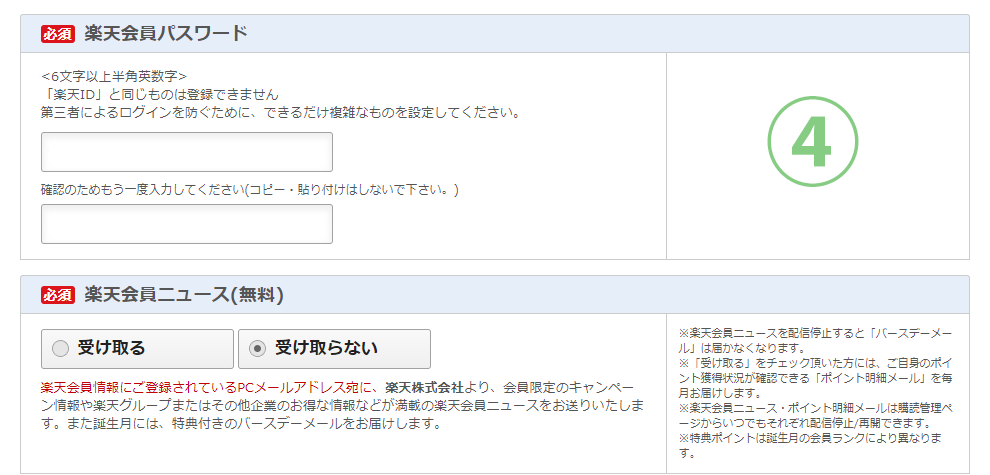

Step 4

Create a Rakuten account

If you don’t have a Rakuten account yet, you will be asked to create one (using the information you filled in previously). Check whether all the information is correct, and just type in a password (twice). Your account ID will be the e-mail address you used for the credit card application.

You will also be asked if you want to receive Rakuten newsletter. Check left for yes and right for no.

Once you’re done, click on the yellow button to go to the next step.

Step 5

Link your bank account

If you selected your bank during the basic information step, you will then have to link your account to your Rakuten card.

Click on the yellow button. If you chose to receive the paperwork at home, you will be redirected to the last step (data confirmation) instead.

1. Select your bank

Choose your bank from the list.

2. Enter branch and account type

Fill in the branch number, select the type of account (should be the first one, regular account), and fill in your account number. Click on the button on the far right (次へ進む) to go to the next step. You will have to confirm your account on the next page.

Step 6

Confirmation

1. Confirm the information you entered

You finally got to the last step!! (well, for the online part). Check whether the information you wrote is correct. Click 修正する to correct any detail.

2. Add password for Rakuten e-navi (optional)

You can add a different password for Rakuten e-navi, for more security. Check left for no, right for yes.

3. The final button!

Check 同意する to indicate you agree to the terms, take a deep breath and click on the red button when you are ready.

4. Wait for your identity check

What follows now is a whole lot of waiting. After you completed your application, you will receive a confirmation email (in Japanese), which informs you among other things that they might call to check your identity. They do so by asking you your name, and date of birth. In my case they called my workplace 4 days after I submitted my application.

5. Wait for your card

If you linked your bank account to your Rakuten card, you should receive your card by mail, within one or two weeks. In the case that you didn’t link your bank account, you will first receive the to return, before finally receiving the long-awaited card.

I hope this article will be of help in your Rakuten card application process! Feel free to share your experience with the Japanese credit card system.

READ ON More on Credit Cards and Cashless Payments in Japan

※We do our best to keep this article up to date. Please keep in mind that things might change and that we cannot take responsibility for the results you may receive from Rakuten. Thank you for understanding.

Recommended Posts

May Sickness: A Japanese Phenomenon

10 5月 2021 - Daily Life, Life