Quick Guide to Japanese Health Insurance

by Madelaine

コンテンツ

Health Insurance while working in Japan

Japan has a strong public health insurance system that offers good coverage to everyone. At first hard to understand, it is surprisingly easy to use.

Insurance Types・Cost・Coverage・Join

Health Insurance Types

Health insurance in Japan is a nationwide system that is split into two main parts.

Social/Employee’s Health insurance: full-time employees

All employees are insured under the 健康保険 (kenkou hoken) also known as Social or Employee Health Insurance (SHI (社会保険, shakai hoken) part of the social insurance of employees).

National Health Insurance: students, self-employed, part-time, eligible foreigners

The 国民健康保険 (NHI, kokumin kenkou hoken) covers all residents of Japan that do not fall under the SHI.

The insurance plan you join is decided by your age, employment status, and place of residence. Your age determines which services are available to you, while the other two help decide the correct insurer and monthly premium.

Cost

With Japanese health insurance you have to pay only 30% of any medical costs when seeing a doctor in Japan. Payment is made on the spot, so don’t forget to bring some money.

There is a cap on your 30% copayment. If your medical expenses exceed a certain amount, everything beyond that limit can be reimbursed as High-Cost Medical Care Benefits.

The limit is 57,600 Yen for anyone earning less than 260,000 Yen per month and calculated using the formula 80,100 Yen + (medical costs-267,000 Yen)*1% for anyone who earns up to 500,000 Yen.

It is calculated on a per-person, per-month, per-hospital basis. You can not add up your payments at multiple medical facilities, nor can you carry over an amount from the last calendar month, because the system resets on the first of every month.

SHI (employees)

For employees in Japan, monthly health insurance premiums are split 50:50 with their employer. The money will be deducted directly from your salary and paid by your company, so there is no need to worry about missing any payments.

It is possible to insure family members as “dependents” if their income does not exceed 1,300,000 yen per year.

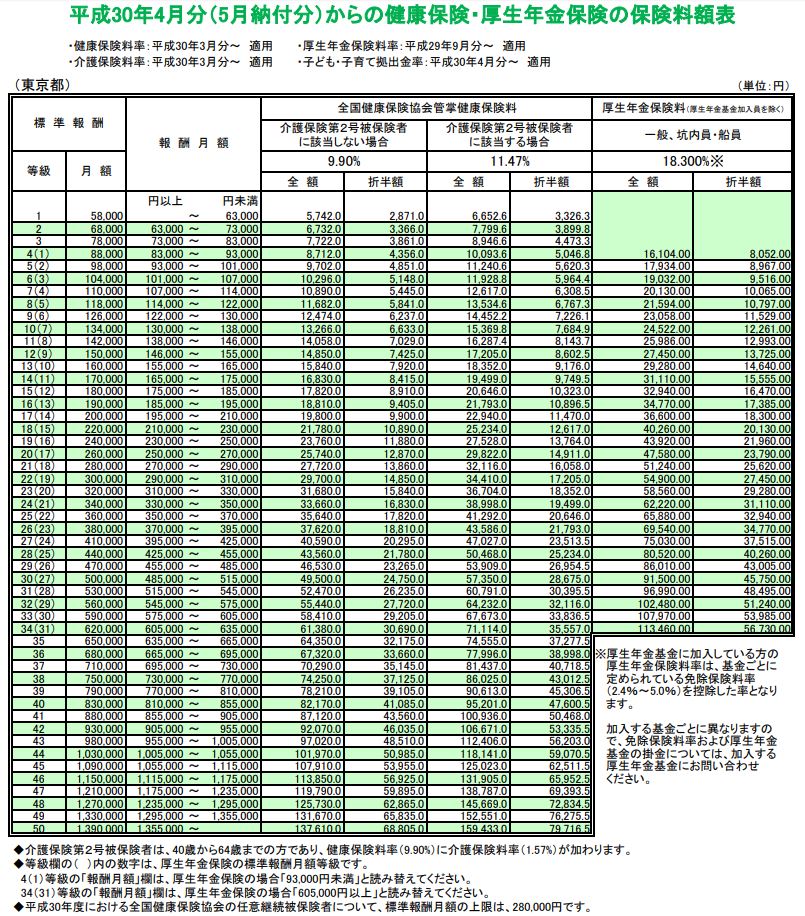

The monthly costs for health insurance vary by region, and prices are adjusted every year.

Let’s look at an example

Full-time English teacher in Tokyo

Monthly total salary: 260.000 Yen

Health insurance cost: 12.870 Yen

NHI (students, etc.)

As a member of the National Health Insurance, payments increase with income and are based on one’s resident’s tax (住民税, じゅうみんぜい), of the previous calendar year. As a student in Japan without a part-time job, monthly fees can be as low as 2.000 Yen per month. National Health insurance premiums are split in 10 installments per year, but you can choose whether to pay monthly or all at once. To pay just go to a convenience store and hand them the payment slip.

Coverage

Over 90% of all Japanese clinics and hospitals accept Social Health Insurance (those who don’t only treat privately insured clients) and you are free to choose which one to go to.

What is covered?

Japanese health insurance covers 70% of everything that is considered a necessary medical treatment related to sickness, accidents, and dental care.

Health Insurance covers:

- ✔ Consultation

- ✔ Medicines or therapeutic materials

- ✔ Necessary treatment, surgery, etc.

- ✔ Nursing or medical care at home

- ✔ Hospitalization

What is not covered?

NOT included in your health insurance are the following cases.

Work-related accidents: These are covered under the worker’s compensation insurance. Accidents during commute also count as work accidents.

Hospital upgrades: Basic hospital costs are also covered to 70% by your insurance, but room upgrades, TV fees, and other expenses come out of your pocket.

Preventive measures: Japanese health insurance only covers the treatment of illnesses, not preventive measures. So, while glasses and caries treatments are cheap, caries prevention, vaccines, orthodontics, etc. are not covered.

Beauty treatments: Japanese health insurance does not cover treatments for things that don’t impede one’s everyday life. So, acne treatments, beauty surgeries as well as braces for your teeth you will have to pay for yourself.

Self-caused health issues: Failure to follow doctor’s orders, self-inflicted injuries (resulting from drunkenness etc.), etc. results in loss of coverage for related medical expenses.

Experimental Medicine: Everything that either isn’t approved yet by the insurer (be it drugs, devices, or procedures) or those deemed to have a low success rate are not covered by Japanese health insurance.

Other benefits

While not covered per se, there are instances where you can apply to get your money back or might be eligible for an additional allowance.

Additional benefits: meal cost during hospitalization (260 Yen/meal), childbirth, maternity allowance, invalidity benefit, funeral allowance, etc.

Reimbursement: overseas treatment, medical appliances, blood transfusions, treatment at healthcare providers that don’t accept the SHI, transportation expenses (when deemed necessary), etc.

To receive these additional services, you have to submit the necessary paperwork. While benefits are granted if you meet the requirements, reimbursements are checked on a case-by-case basis and the process can take around 3 months.

Also keep in mind, that you may not receive the full amount and that the right to claim benefits or reimbursement expires after 2 years.

Get your health insurance card

SHI (employees)

If you have a job offer then your company will take care of the application for the SHI for you! Employees of small and middle-size companies are insured by the 協会けんぽ (きょうかいけんぽ) whereas large companies use separate private insurers. Even if you change jobs or move, your employer will take care of all necessary paperwork.

NHI (students, etc.)

Enrollment in the national health insurance is mandatory for everyone who stays in Japan for 3 months or more. The national health insurance is managed on a municipal level and you have to register within two weeks after arriving in Japan. So, when you head to your local municipal office to register your Japanese address, just get your health insurance taken care of at the same time.

Since you are insured by your municipality, you have to change your health insurance when you move to a different area. The bureaucracy is a little inconvenient, but your coverage will stay the same. To change your health insurance go to the municipal office of your old place within two weeks before or after your move and sign out of the system. With the paper slip you receive there you can then go to your new municipal office to sign up again.

If you don’t make the deadline you can still register at a later point. Just beware that this means you have a longer time without health coverage, are breaking the rules, and can be asked to pay up to two years of back payments.

Recommended Posts

May Sickness: A Japanese Phenomenon

10 5月 2021 - Daily Life, Life