Taxes and Insurance when Working in Japan

by Madelaine

Taxes and insurance payments far too often are mystery to the brave souls venturing to build a life in Japan. Imagine the surprise when you notice that after finally having settled in and just starting the second year at a company, suddenly the money in your bank account is less than in the months before!? The Japanese tax system got to you.

We looked at taxes and insurances of employees in Japan, and summarized what you need to know to understand this complex topic.

コンテンツ

Example calculation

Before we get into the details of the how and why, here are the essentials.

Let’s assume you earn ¥270,000 per month, including all your allowances. This means your gross annual income is around ¥3,240,000.

Expect to pay 20% of that annual income on taxes and insurances, leaving around 80% as net income.

Net income = Salary – Insurance – Income Tax – Residence Tax

Your net income will be around ¥2,598,000 per year.

The ¥643,000 or 20% of your income includes:

- ■ 14% Insurance and Pension, ¥442,000

- ■ 2% Income Tax, ¥64,000

- ■ 4% Resident tax, ¥137,000

More on calculating your taxes and insurance costs below!

Tax and insurance payments

You actually do not need to worry about taxes too much. When you are employed full-time you can just let the company take care of your tax payments. But what happens to those 20% of your salary that you never get to see?

Standard Taxes

- ■ Income Tax (所得税, しょとくぜい)

- ■ Resident Tax (住民税, じゅうみんぜい)

- ■ Pension Insurance (厚生年金保険, こうせいねんきんほけん)

- ■ Health Insurance (健康保険, けんこうほけん)

- ■ Unemployment Insurance (雇用保険, こようほけん)

Most taxes and insurance payments follow standard premium rates and are paid by everyone. As the salary increases, so will tax payments and premiums and the difference between gross and net income will grow bigger. A few other factors that can play a role are company rules, household composition, managerial rank, etc.

Special Taxes

- ■ Labor Union Fee (労働組合費, ろうどうくみあいひ)

- ■ Property Accumulation Savings (財形貯蓄, ざいけいちょちく)

- ■ Nursing Insurance (介護保険, かいごほけん, people over 40)

- ■ Additional Taxes are possible

1. Income Tax

Everyone in Japan is paying income tax (所得税, しょとくぜい) based on their salary. Your company will deduct the money from your monthly salary and handle payments to the tax office (withholding tax).

Your income tax is calculated the following way:

Income Tax = taxable income x tax rate – tax deductions

The amount withheld is only an estimate. Once a year it will be adjusted. Around the end of every year, you will receive a notice from the authorities, either telling you that you paid too much and will get a refund, or that you did not pay enough, in which case a bill will be attached. Compared to your salary this should be a relatively minor amount as long as you didn’t make sudden jumps in your income.

1.1. Tax rate

You can find the tax rate for your income in the table below.

| Taxable Income | Tax Rate | Deductible Amount |

|---|---|---|

| Under ¥195,000 | 5% | ¥0 |

| Between ¥195,000 – ¥330,000 | 10% | ¥97,500 |

| Between ¥330,000 – ¥695,000 | 20% | ¥427,500 |

| Between ¥695,000 – ¥900,000 | 23% | ¥636,000 | Between ¥900,000 – ¥1,800,000 | 33% | ¥1,536,000 | Between ¥1,800,000 – ¥4,000,000 | 40% | ¥2,796,000 | Above ¥4,000,000 | 45% | ¥4,796,000 |

1.2. Tax deductions

The last element in calculating your Income tax are tax deductions (税額控除, ぜいかくこうじょ). Tax deductions apply to income from dividends of stock shares of Japanese companies, foreign tax credit, donations, Japanese mortgage loans, etc. If these don’t apply to you, then just take the tax rate from the table and your taxable income to calculate your income tax.

1.3. Tax exempted allowances

So far so good, but how do you know what your taxable income (課税所得, かぜいしょとく) is and how is it different from your total income?

Taxable income = total income (base pay, overtime pay, allowances) – tax exempted allowances – income deductions.

Tax exempted allowances or tax-free benefits (非課税の手当, ひかぜいのてあて) are those payments that you receive by your company to cover work-related costs. For example, if you receive a commuting allowance, it is part of your income but the money is tax-free because you will use it to cover specific expenses you incurred for the company.

Tax exempted allowances include:

- ■ Commute cost

- ■ Travel expenses for business trips

- ■ Cost for certification directly relevant to your professional duties

- ■ Cost for training directly relevant to your professional duties

- ■ Donations

- ■ Work-related entertainment expenses

1.4. Income Deductions

While tax exempted allowances are tax-free income, these Income Deductions (所得控除, しょとくこうじょ) like those below are not considered as income at all (in as far as taxes are concerned).

- ■ Standard deduction: ¥380,000 deduction (all taxpayers)

- ■ Miscellaneous losses: amount of damages or loss due to fire, robbery etc.

- ■ Medical expenses: partial deduction of medical and nursing fees

- ■ Social (health) insurance, life insurance, earthquake insurance

- ■ Working student: special deductions when below certain income level

- ■ Marital deduction: applied if spouse’s income is below certain level

- ■ Further deductions: dependents, disabled people, widow(er) with kids, etc.

Subtracting the above points from the total income, one can estimate the taxable income.

Taxable income = total income (base pay, overtime pay, allowances) – tax exempted allowances – income deductions.

and then finally gives you the income tax you have to pay.

Income Tax = taxable income x tax rate (-tax deductions)

2. Resident Tax

Everyone living in Japan is subject to resident tax. This is a local tax, going toward the region or city you live in. If you earned less than ¥350.000 the previous year you don’t have to pay resident tax. If you are employed, then your company will withhold the amount from your monthly paycheck.

To put it simply, your residence tax will be around 10% of your taxable income, with 4% as prefecture tax and 6% as municipal tax.

Residence Tax = Total taxable income (see above) x 10%

While income tax is calculated on your income that very month, resident tax is calculated based on the income of the previous year. The cut-off date is January 1st of every year. So, if you start your very first job in Japan, you won’t have to pay resident tax for the first year.

While this is great news, ready yourself. From the second year, your disposable income might be less than it used to be, due to the sudden withdrawal of resident taxes.

3. Pension Insurance

Often only called 年金 (pension, ねんきん) the proper name is 厚生年金保険 (こうせいねんきんほけん). Anyone working for a company in Japan (including private school staff, etc.) and who is under 70 years of age is in the system. (There is also 厚生年金基金 (welfare pension fund, こうせいねんきんききん), but since it is largely irrelevant for non-Japanese we will omit it here.)

While everyone pays into the government pension system on their own, the pension insurance is deducted from the employee’s salary and paid by the company directly.

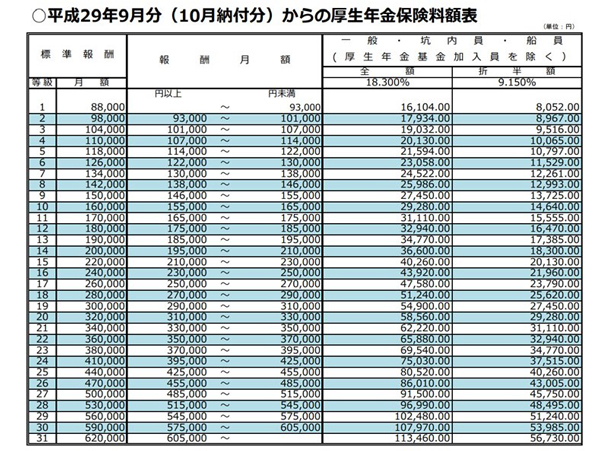

There are over 30 grades in the pension insurance system, depending on which the payable amount is set. The rate of the insurance premium is revised every year. Although we put the most recent data at the time of writing, remember to check their homepage for changes.

Pension insurance premium amounts from 2017. Actual cost for employees, half of the total amount, is written on the very right.

4. Health Insurance

Everyone living in Japan has to join the national health insurance, this includes exchange students and international employees.

There is a difference based on the status of residence though. Exchange students join the 国民健康保険 (national health insurance, こくみんけんこうほけん), while those on working visa join the 社会保険に属する健康保険(health insurance under the social insurance, しゃかいほけん・に・ぞくする・けんこうほけん).

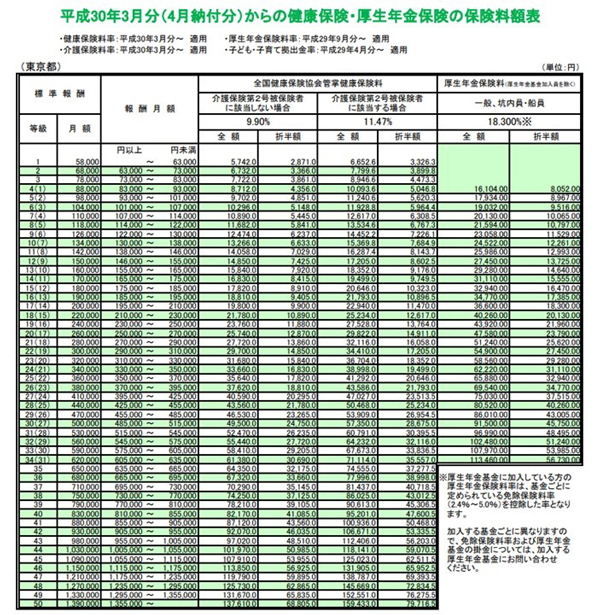

The insurance premium varies by prefecture of employment and also depends on the company size. As a reference, here are the premium rates of the 協会けんぽ in the Tokyo area. Insurance rates can change every year, so check the respective homepage for the latest numbers.

5. Unemployment Insurance

Employment insurance 雇用保険 (こようほけん) is part of the government-controlled 労働保険 (labor insurance, ろうどうほけん) together with a 労災保険 (worker’s accident insurance, ろうさいほけん, also called 労働者災害補償保険). While unemployment and accident insurance are two separate insurance, payment is handled jointly.

The accident insurance is paid by the employer. The employment insurance premium is paid jointly by company and employee. So, while employees still have to bear some cost, most of the insurance premium will be paid by the company.

Employment insurance premiums are applied to income before the deduction of any taxes, social insurances fees, etc.

Wages include various allowances, listed below:

- ■ Commuting allowance

- ■ Overtime, late-night, night shift allowances

- ■ Family, child allowances

- ■ Skill, education, special task allowances

- ■ Housing allowance

- ■ Good attendance and other incentive allowances

- ■ Business holiday allowance (payable for days off due to company circumstances)

- ■ Further allowances: executive allowance, retirement payments, etc.

Different from other insurance premiums, employment insurance premiums are based on the type of business.

Get an estimate

All these details are great, but you just want to have an estimate of how much taxes and insurance you have to pay, without breaking your head? Then try these two sites.

Just enter your annual income and the Japan tax calculator gives you a visualized overview of your tax and insurance payments.

For more detail head to the payroll calculator of HTM, which gives more insight into the company side payments.

Recommended Posts

How to Get Along with Your Japanese Boss

25 5月 2021 - Work, Working Culture

The 10 Most Popular Japanese Companies in 2021

19 5月 2021 - Work